Intel has recorded impressive profits in the second quarter of 2023. In its financial report, Intel achieved a net profit of $1.5 billion from a revenue of $12.9 billion. The success is primarily attributed to the significant contributions from Intel’s PC division, leading to an 8% surge in the company’s stock.

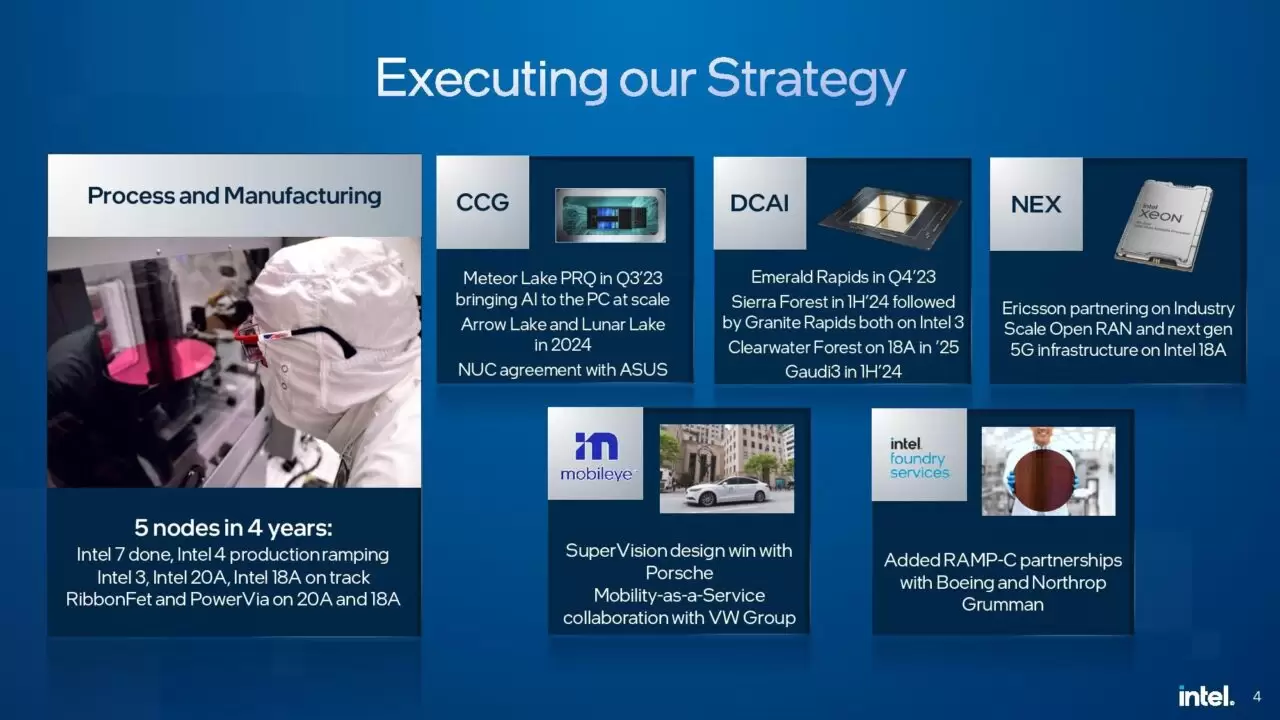

Intel managed to achieve an earnings per share (EPS) of $0.13, which greatly surpassed the previous estimate of -$0.19. Intel’s CEO, Pat Gelsinger, expressed his excitement over this achievement and reaffirmed that the company remains on track to accomplish its ambitious goal of completing five generations of node processor architecture within four years.

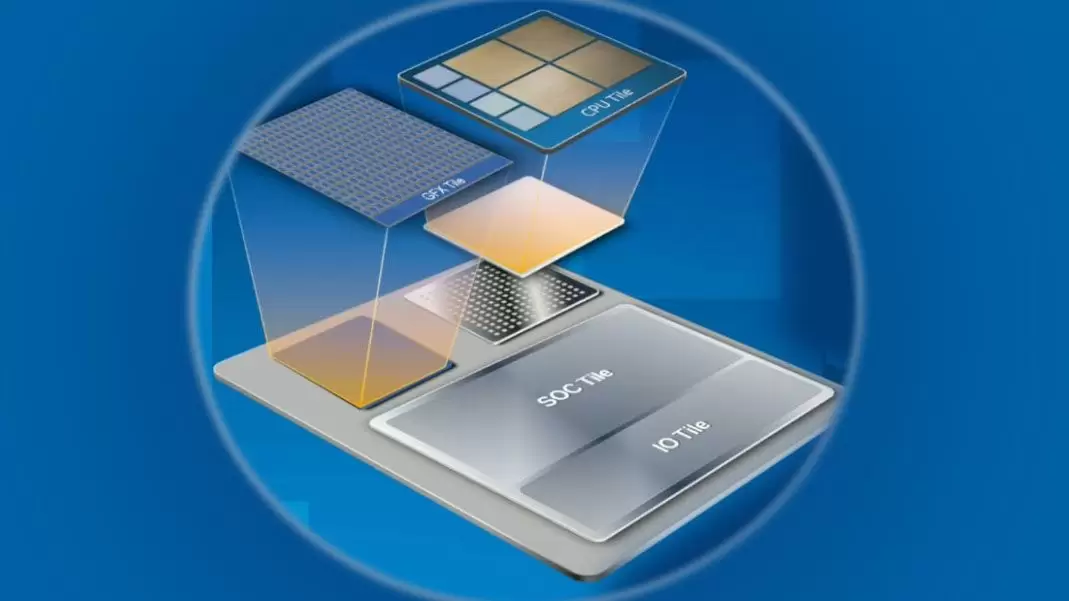

In addition to the financial accomplishments, Intel announced significant progress in developing the next-generation processors. The Meteor Lake chip, utilizing the ‘Intel 4’ node, has entered the production phase and is scheduled for launch in the third quarter of this year. Meteor Lake is expected to bring a remarkable increase in performance, providing users with an advanced computing experience.

Alongside Meteor Lake, Intel is also preparing for the launch of another next-generation processor, Arrow Lake. This chip employs the latest 20A (2nm) node and has reached the fabrication stage. As per Intel’s roadmap, Arrow Lake is set to be released in the year 2024.

Of note, Arrow Lake will be Intel’s first chip to utilize PowerVia backside power delivery and RibbonFet Gate-All-Around (GAA) technology, which is anticipated to enhance efficiency and deliver higher performance in its use.

While Intel successfully achieved a 19% increase in operational revenue from consumer CPU sales, the company also faced a 12% decline in consumer CPU sales in this quarter. Nevertheless, Intel projects a bright future, with expectations that sales of the fourth-generation Xeon processor, “Sapphire Rapids,” will reach one million units in the coming days.

Unfortunately, Intel’s Data Center and AI Group (DCAI) experienced a 15% decline in revenue, resulting in negative operational margin (-$200 million). However, the company remains committed to efforts towards recovery and improving the performance of this division.

On a positive note, Intel Foundry Services (IFS) recorded significant achievements, with a revenue increase of 307% compared to the previous year. This success is largely attributed to new packaging agreements and sales of IMS nanofabrication tools. Moreover, IFS packaging services have garnered interest from external customers, indicating substantial growth potential in the future.