Nvidia has established itself as the biggest and most successful graphics card manufacturer in history, despite the best efforts of its competitor AMD. However, being at the top doesn’t mean that Nvidia has never stumbled. In fact, just like its toughest rival, Nvidia has had some significant missteps over the years that have resulted in embarrassment at best and billions of dollars wasted at worst.

If you’ve come to see Nvidia’s most noteworthy blunders, you’ve come to the right place. Here are some of the company’s most significant failures.

GTX 480

Nvidia has established itself as a leading manufacturer of graphics cards, producing some of the best GPUs in the market today. However, the company has also had its fair share of failures, with some of its cards being considered downright terrible. One of the worst GPUs ever produced by Nvidia is the GTX 480, which was built on the Fermi architecture.

The GTX 480 was notorious for being incredibly power-hungry, consuming as much power as some dual card systems from AMD. This, in turn, led to sky-high temperatures that made it difficult to run without overheating. While it was just about the fastest single-die graphics card at the time, multi-GPU configurations were still viable in 2010, and the GTX 480 could not compete. Additionally, its high price of $500 was not justifiable given its poor performance.

Overall, the GTX 480 was too expensive, too hot, too power-hungry, and not fast enough to justify any of it. While Nvidia has since moved on from the Fermi architecture, the GTX 480 serves as a reminder that even the biggest players in the industry are not immune to making mistakes.

RTX launch

In 2018, Nvidia released its RTX 2000-series, which was supposed to be a groundbreaking development in graphics card hardware. The first generation of GPUs had new hardware accelerators for specific tasks such as deep learning super sampling and ray tracing. However, Nvidia faced challenges as these tasks were unheard of and there were few games that supported them.

The first attempt at deep learning super sampling was underwhelming and came with too many visual artifacts. Ray tracing was even worse, with limited effects on game graphics and crippling performance on even the most expensive of Nvidia’s new cards.

The expensive cards were not great when they were not ray tracing either. The RTX 2080 was only about as competitive as the GTX 1080 Ti, which was released a year and a half earlier and cost $100 less. Although the RTX 2080 Ti had a big performance improvement, its high price tag was a hard sell.

As a result, the generation never really recovered, and only a few of the low-end cards ever found much purchase in gamers’ PCs. The RTX brand is now a mainstay in the industry with ray tracing and upscaler support being significant factors in modern graphics card reviews. But Nvidia’s first attempt with RTX 2000-series faced a classic chicken-and-egg problem, and the company ended up with a proverbial zygote all over its green face.

ARM acquisition attempt

Nvidia’s attempt to acquire Arm in 2020 was set to be one of the largest technology acquisitions in history. Arm, a British-based chip manufacturer, was valued at $40 billion, with an additional 10% share of Nvidia included in the deal. Nvidia’s goal was to use Arm’s technology to expand its footprint in the AI and data center markets.

However, the UK’s Competition and Markets Authority (CMA) raised concerns about the acquisition, citing potential antitrust issues. The CMA suggested that if Nvidia owned Arm, it could restrict competitors’ access to Arm chips, leading to a lack of competition in the marketplace. This prompted the CMA to investigate further, ultimately causing the deal to be delayed.

In 2022, the European Commission also launched an investigation into the acquisition, concerned that the deal would give Nvidia too much knowledge of its competitors due to Arm’s previous deals with Nvidia’s competitors. The European Commission’s investigation led to further delays and increased skepticism about the deal’s success.

Ultimately, the regulatory hurdles proved too great, and the acquisition was called off in February 2022. The deal’s value had skyrocketed to an estimated $66 billion by the time of the cancellation due to stock price changes. This failure to acquire Arm was a significant setback for Nvidia, as the company had hoped to use Arm’s technology to strengthen its position in the highly competitive AI and data center markets.

Over-reliance on crypto mining

Cryptocurrency mining has been a major cause of graphics card shortages and pricing crises in recent years. However, it was the crypto boom that occurred from 2017 to 2019 that made it clear just how much of a factor it was. Nvidia attempted to downplay the role of crypto mining in its graphics card sales, claiming it was only a small portion. But this turned out to be misleading as purchases of smaller numbers of cards were still counted as gaming-related sales, regardless of their actual purpose.

Nvidia’s ability to sell cards at a premium was not impacted by this obfuscation as the demand was high, but the crypto winter that followed the boom had a significant impact. GPU sales fell sharply as prices crashed in early 2018, causing Nvidia’s stock price to plummet by 50% in just a few months. The lackluster launch of the RTX 2000-series later that year also contributed to further declines as Nvidia’s cryptocurrency mining sales continued to contract.

In addition to these challenges, Nvidia faced an investigation by the U.S. Securities and Exchange Commission (SEC) for misleading investors about the significance of its cryptocurrency mining sales. The investigation revealed that Nvidia had misrepresented the scale of its mining-related revenue, resulting in the payment of a $5.5 million fine in compensation in 2022.

In summary, Nvidia’s attempts to downplay the role of cryptocurrency mining in its sales and the subsequent decline in demand following the crypto boom had a significant impact on the company’s stock price and profitability. The SEC investigation added further challenges to an already difficult situation.

RTX 4080 12GB unlaunch

Nvidia’s launch of the RTX 4080 12GB was met with immediate criticism from gamers and enthusiasts, who felt that the company was trying to deceive them. This product, which was presented alongside the RTX 4090 and RTX 4080 16GB, was criticized for its high price, cut-down performance, and misleading name.

In reality, the RTX 4080 12GB was simply an RTX 4070 in disguise. Nvidia eventually relaunched the product as the RTX 4070 Ti several months later. However, this did not alleviate the damage that had already been done. The launch had resulted in wasted time and resources, including the development of BIOS for the card, custom cooler designs, and marketing campaigns.

Nvidia had to compensate its board partners for all the RTX 4080 12GB packaging that had to be destroyed. Nonetheless, this did not account for the larger issue of how the launch had affected the company’s reputation among gamers and enthusiasts.

While Nvidia did not cancel the RTX 4080 12GB outright, the launch was widely considered a mess. It highlights the importance of transparency and honesty in product launches, especially when it comes to high-end graphics cards that are designed for demanding users who are knowledgeable about the products they buy.

Hairworks

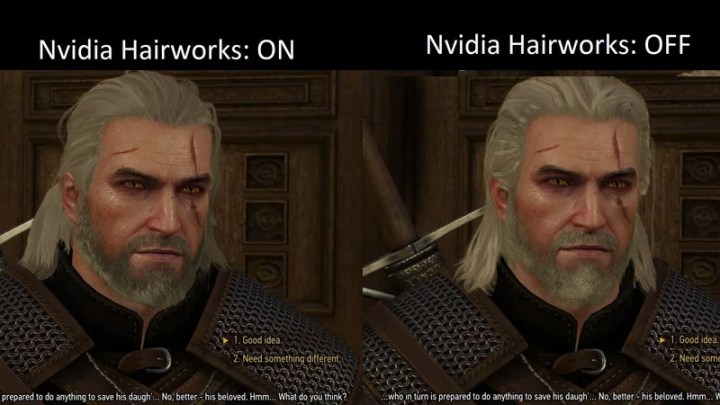

Nvidia’s Hairworks, a software project developed to enhance the realism of hair and fur in games, is one of the company’s most controversial projects. Hairworks was an extension of PhysX technology, which Nvidia acquired when it bought Ageia in 2008. The software was initially used in The Witcher III: Wild Hunt, which was applauded for its impressive graphics. However, Hairworks failed to live up to its hype, and its impact on gaming performance was significant. It reduced frame rates by 10-20 fps, even on high-end gaming PCs.

Hairworks was locked to Nvidia hardware, which limited its adoption across games. The hair of Geralt, the game’s protagonist, was overly smooth and shiny, making it too distracting for many gamers. The performance hit was impossible to justify. However, some gamers appreciated the effect, particularly the hair and fur on some of the game’s monsters, which looked more lifelike.

Hairworks hasn’t seen much adoption across games, even those that feature a lot of hair and fur effects. Although its performance impact has decreased, many gamers would still rather do without it. Despite its mixed reception, Nvidia continues to develop and release new versions of the software. However, with the advent of new technologies like ray tracing, Hairworks’ relevance and usefulness may continue to diminish.

Losing EVGA

The announcement of EVGA’s exit from the GPU business in August 2022 came as a surprise to many PC enthusiasts. EVGA had been a long-standing partner of Nvidia and had been manufacturing graphics cards for over 20 years, producing some of the most iconic ranges of enthusiast GPUs. However, the rift between the two companies had soured considerably over the years, and it was ultimately Nvidia’s actions that led to EVGA’s departure.

EVGA’s CEO, Andrew Han, cited several reasons for the break in the relationship, including Nvidia’s continued price rises, selling of its-own first-party GPUs, and a fall in margins for GPUs over several generations. These factors made it an industry that EVGA no longer wanted to be a part of, and the company decided to exit the GPU business entirely.

This decision has not only affected EVGA but also Nvidia and PC enthusiasts. EVGA was responsible for as much as 80% of its business related to GPU sales, and its exit has left a significant gap in the market. Nvidia undoubtedly had to shift its stock of new cards to other board partners, but it lost something special with EVGA. PC enthusiasts who enjoyed the company’s iconic graphics cards, including the KINGPIN editions, will also feel the impact of EVGA’s departure.

The exit of a long-standing and significant partner like EVGA from the GPU business is a reminder of the challenges and changes that the tech industry continues to face. While Nvidia and other companies continue to innovate and push the boundaries of what’s possible, they must also be mindful of how their actions and decisions affect their partners and the wider community of PC enthusiasts.